SBK saga: Perfect example of how money gets laundered in Turkey

Sezgin Baran Korkmaz, who is being prosecuted for money laundering in Turkey, fled to Switzerland on April 14 after an international travel ban on him was lifted. This perfectly depicts how Turkey’s ‘sharing economy’ condemns some to hell while preparing cushy beds for others. Despite being tied up in well-documented money laundering schemes, Korkmaz was not even questioned. Yet again we see a commerce-politics relationship with too many questions and not nearly enough answers.

With a view of the Swiss alpine lake in the background and a patio table cluttered with fruits and drinks, a man sits in front of a computer smiling. He picks up a pen and pretends to write something on a pad of paper as the camera pans off to the landscape beyond.

Such is the life of Sezgin Baran Korkmaz, who is being prosecuted for money laundering. Korkmaz posted this bizarre video from Switzerland where he fled on April 14. This perfectly depicts how Turkey’s ‘sharing economy’ condemns some to hell while preparing cushy beds for others. All of those politicians, business partners, and supporters who walked hand-in-hand with Korkmaz for the 10 years when he was a ‘celebrated businessman’ distributing millions of dollars, have suddenly vanished. As are those who welcomed him into to Switzerland when the state of his deterioration became unsalvageable.

The requested sentences in the indictment against 10 individuals connected to SBK Holding and Korkmaz, its owner, vary between 4 years and 7.5 years 6 in prison. If he is found guilty and apprehended, Korkmaz won’t do much time.

So, how much money was laundered and how was it done?

The Financial Crimes Investigation Board (MASAK) submitted its preliminary investigation to the public prosecutor’s office on December 28, 2020 and the final report numbered 2021-ASİR/VM/1757/1 on January 20, 2021. Nearly 132 million dollars were allegedly laundered after the incident.

Various channels were used to launder the money. The most common method is to split and circulate the money from one account to another.

The company in question is Konak Heat, which was founded in 2009. Its shares were distributed with 5 percent going to Yusuf Araz and 95 percent going to Korkmaz. In 2012, 95 percent of those shares were transferred to Kamil Feridun Özkaraman. In 2015, he owned 100 percent of shares. The company has not imported and exported anything since it was founded. Here’s how the money trafficking works:

First 4 million dollars and then 5 million dollars came from the Washakie Renewable Energy in the U.S. on September 9, 2013. Another 13 million dollars was transferred from the same company on December 31, 2013. On March 22, 2016, 3.81 million dollars came from Noil Energy. The total transfer amounted to 25.8 million dollars. The next step was to move this money from one account to another.

Money moves

The 4 million dollars that arrived on September 9, 2013, was withdrawn by Özkaraman two days later in instalments of 1 million dollars each. He deposited this amount in the same bank five days later in two parts as 2 million dollars each. Özkaraman then withdrew 4 million of the 13 million dollars that arrived on December 31, 2013 in two separate transactions. Another 3.81 million dollars, which was sent from the U.S. on March 22, 2016, was transferred to another account in another bank a day later. This amount of money was withdrawn via four different transactions on two different days. Within this process, 5 million, 2 million, and 2 million dollars were transferred from the Turkish company’s account to the account of Speedy Lion Renewable in the U.S. Another 9 million dollars went from the same account to Speedy Lion Renewable in January 2014. Thus, Özkaraman transferred a total of 18 million dollars to Speedy Lion Renewable.

There is another set of transfers which is interesting: Özkaraman sent 5.61 million dollars to Kingston’s account in the U.S. at the same bank on January 16, 2015. Kingston transferred this amount to an account in the same bank; the receiving company was Setap Teknik (renamed Blane Teknik later). This money was then transferred to the account of Ayşe Nil Yılmaz at the same bank on the same day. Ayşe Nil Yılmaz withdrew this money on the same day.

According to MASAK’s investigation, the total sales revenue of Konak Isı between 2013 and 2019 was 18.6 million liras. The money that entered the company’s accounts is 12 times more, at 217.58 million liras. The money this company spent on the total purchase of goods and services was 16.2 million liras, but the amount left in the company’s accounts was 12 times more, at 227.79 million liras.

The company, which does not do any concrete work, has been operating like this for years. All this in addition to a number of criminal charges against Özkaraman along the way:

In the 2016 tax audit, the invoices that Konak Isı issued to the Kay Group Tourism Construction were found to be forged. So, a criminal complaint was filed against Özkaraman. In 2017, the Capital Markets Board (SPK) investigated Ataç Construction, a company in liquidation, and criminal charges against Özkaraman were filed because the investigation proved that he been cooking the books, opening false accounts, and issuing fictitious invoices between subsidiaries Anteks and Antalya College. It does not stop there. In 2017, the SPK filed another criminal complaint against him for siphoning off Kervansaray Investment Holding. The final criminal complaint against him was filed because of irregularities within Mega Asset Management.

Korkmaz’s laundering chain

The money laundering chain of Korkmaz was diagramed in the MASAK report. The money from Washakie in the U.S. was first sent to a foreign company in Turkey called ISANNE S.A.R.L. Then, it traveled to Bioforma Pharmaceuticals-Münir İlaç-SBK Holding and came into to Korkmaz’s bank account. From there, it was transferred to Korkmaz's account in the U.S. Korkmaz has used every company he owns in similar chains. MASAK experts say that almost all his companies have lost money.

The second common method used in money laundering is real estate purchases. As a matter of fact, almost all the money sent to Blane Tech from the U.S. was invested in 31 properties in 2014 and 2015. What is notable here is that these properties were bought from the same individuals and companies. For example, 11 properties in Beşiktaş, Istanbul, were bought from H.İ.; Another 14 properties in Ataşehir, Istanbul, were from Ç.S., who owns a construction company; Another 12 properties in Ataşehir were bought from C.P.; And another five properties in Beşiktaş were purchased from a law firm.

In the MASAK report, money transfers are listed day by day, bank by bank, and name by name. But there are still a number of questions that need to be answered.

SBK Holding’s reputation comes from its acquisition of companies which have had financial troubles for years or are on the verge of bankruptcy. For example, companies such as Bora Jet, Ürosan Kimya, Biofarma, Münir İlaç, and Umut İlaç are known as having long histories of operating in the market. Could it be that the money transferred to them were criminal proceeds?

Another question concerns Mega Asset Management being at the heart of everything. It is one of the largest with a capital of 100 million liras. It has added a significant amount of loans to its portfolio that banks were not able to collect. The MASAK report shows that the company is the epicenter of money laundering in Turkey. The sentence at the end of the report is important: “Mega Asset Management was founded with money from criminal proceeds.” However, we can only see the account movements of the owner of the company. In the meantime, let’s note that between 2016 and 2017, Ekim Alptekin was among the management, the former head of the Turkish American Business Council (TAİK). His name also comes up frequently in the ruling Justice and development Party’s (AKP) relations with the U.S.

On September 30, 2020, the Office of the Istanbul Public Prosecutor demanded that the assets of the companies be seized from the court as part of the investigation and Judge Furkan Bilgehan Ertem agreed. However, on November 5, Istanbul’s 3rd Court of Minor Offences Judge Yasin Karaca lifted the orders on the grounds that “concrete evidence had not been detected,” referring to a letter from MASAK. The decision was sent to the Banks Association of Turkey by the Istanbul Public Prosecutor's Office, Bureau of Investigation of Terrorism Crimes on the same day, requesting the “immediate” removal of measures on the company and personal accounts of Korkmaz and other suspects. The person who signed the document is Hasan Yılmaz, deputy chief prosecutor of Istanbul, who was later to become Deputy Minister of Justice.

Ten days later, on November 17, 2020, an international travel ban on Korkmaz was lifted by 7th Magistrate Ramazan Çiçek. It was understood through this decision that Korkmaz has not even been questioned. Approximately two months later, based on MASAK's ‘black money’ report, detention and asset measures were decided upon for Korkmaz and the other suspects. But Korkmaz and eight others have already moved abroad. Moreover, he had already sold his villa, some of his properties, and his pharmaceutical company.

Here we see yet another commerce-politics relationship with too many questions and not nearly enough answers. Wherever money is accumulating in Turkey, there is an automatic shield of protection. Korkmaz is one, but not the only, lucky person to enjoy such privileges, well, in Switzerland.

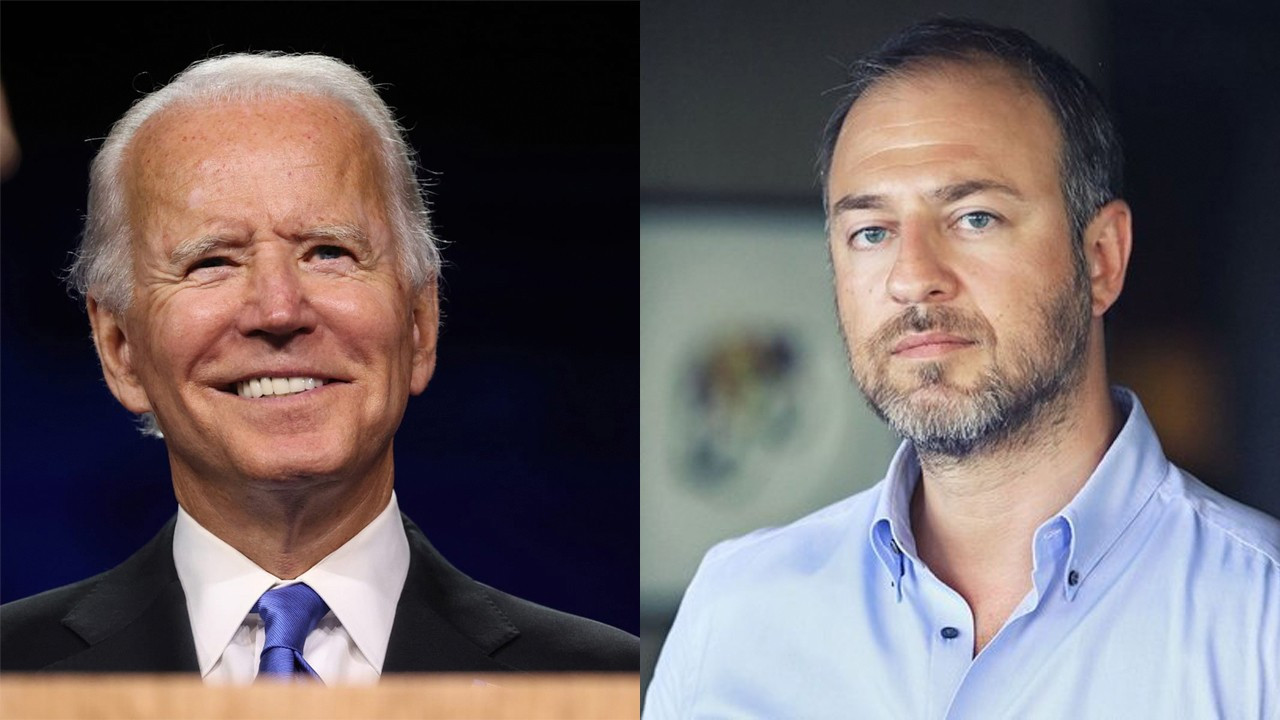

Turkish businessman hosted Joe Biden's brother on vacation in TurkeyPolitics

Turkish businessman hosted Joe Biden's brother on vacation in TurkeyPolitics