Turkey's central bank sees longest reserves increase since 1987, spanning 15 consecutive weeks

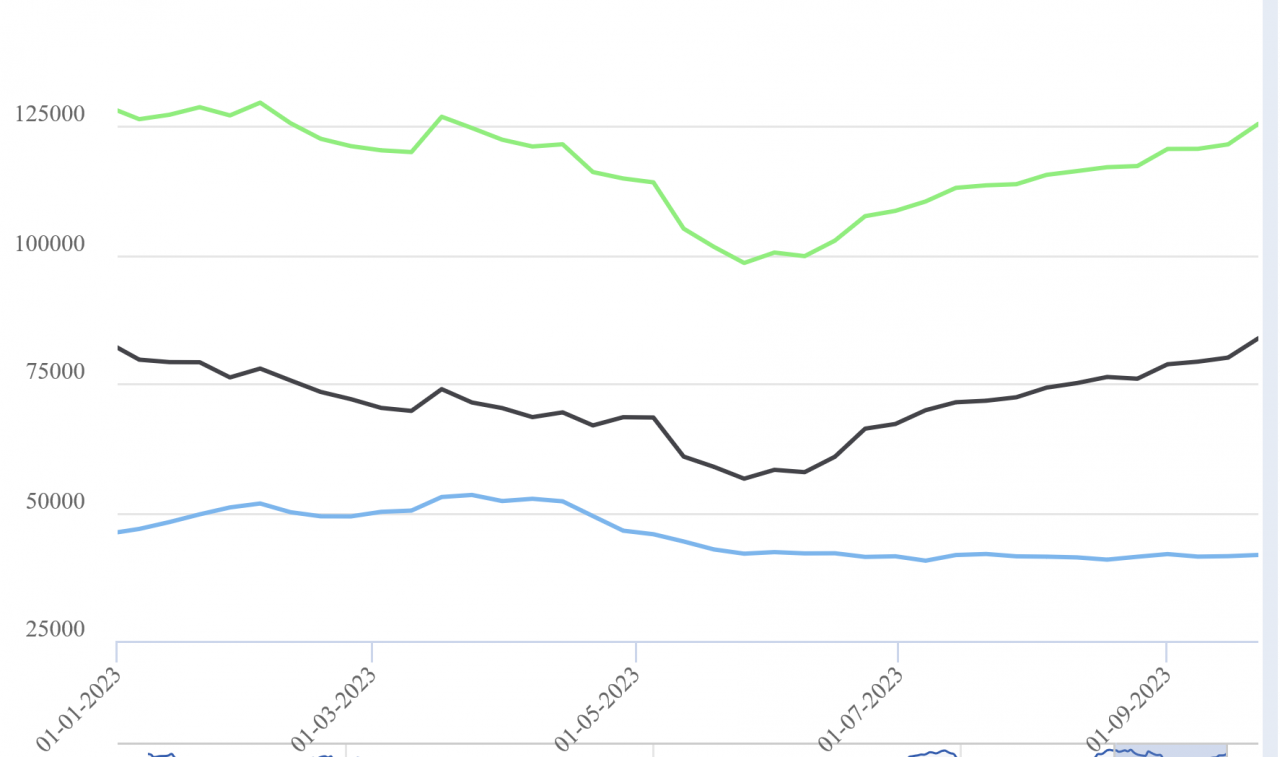

Turkey's Central Bank's total reserves have increased for 15 consecutive weeks and reached 125.5 billion dollars, recording the most prolonged increase in the data dating back to 1987.

Duvar English

Gross foreign exchange (FX) reserves of Turkey’s Central Bank increased by 3.7 billion dollar and net reserves by 6.4 billion dollar as of Sept. 22.

According to the bank's data, gross FX reserves rose to $83.8 billion, the highest level since Dec.16 2022. Net FX reserves, on the other hand, rose to $24.3 billion, the highest level since Feb. 10 2023. Also, gold reserves were 41.7 billion dollars.

Therefore, total reserves increased from 121.5 billion dollars to 125.5 billion dollars.

While the upward trend in reserves was carried to the 15th consecutive week, total reserves, which stood at 98.5 billion dollars as of the end of May, increased by approximately 27 billion dollars since then.

Meanwhile, total reserves recorded the longest increase record in the history of the bank’s data, which started in 1987.

The bank’s FX reserves hit a historic low on June 2 due to policies including the use of reserves to protect the value of the Turkish lira ahead of the general elections in May. The Central Bank's reserves had fallen to minus 5.7 billion dollar in early June which was the lowest level since 2002.

Turkey's Central Bank has sold approximately 199 billion dollars in foreign currency from December 2021 to the end of May 2023, as part of their backdoor interventions aimed at maintaining stable exchange rates.

The government made a sharp U-turn in policies with the new economic management appointed after the elections.

The central bank administration, led by Hafize Gaye Erkan, applied orthodox economic methods and has been raising interest rates after a long time. The bank has raised the weekly repo rate by a total of 2,150 points since June.

The bank on Sept. 21 raised the policy rate by 500 basis points to 30 percent, in line with market expectations.

The bank also started to withdraw from its FX-protected deposit accounts scheme (KKM), which became a major burden on reserves.

Turkish central bank removes interest threshold in FX-protected deposits to make it less desirableEconomy

Turkish central bank removes interest threshold in FX-protected deposits to make it less desirableEconomy Turkish Central Bank raises interest rate for fourth month in a rowEconomy

Turkish Central Bank raises interest rate for fourth month in a rowEconomy Turkish central bank's net forex reserves fall below zero after 21 yearsEconomy

Turkish central bank's net forex reserves fall below zero after 21 yearsEconomy