Turkey’s clean energy future tied to emerging nuclear era

Turkey, Europe’s top coal polluter, has been advancing one of the world’s largest nuclear power development pipelines to boost energy output and curb emissions.

Reuters

Europe's top polluter from coal-fired power production has one of the world's largest nuclear power development pipelines that could help it boost power output and limit future emissions.

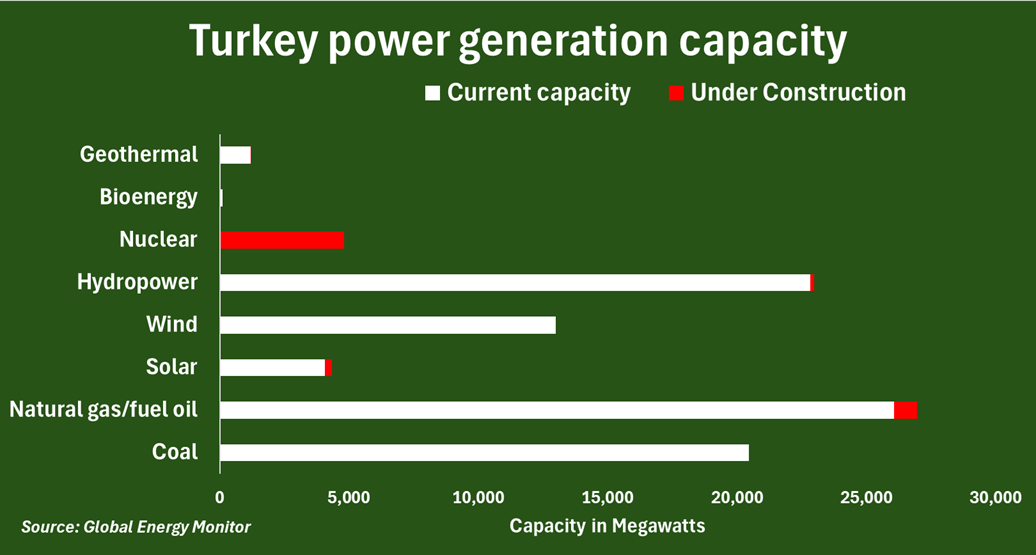

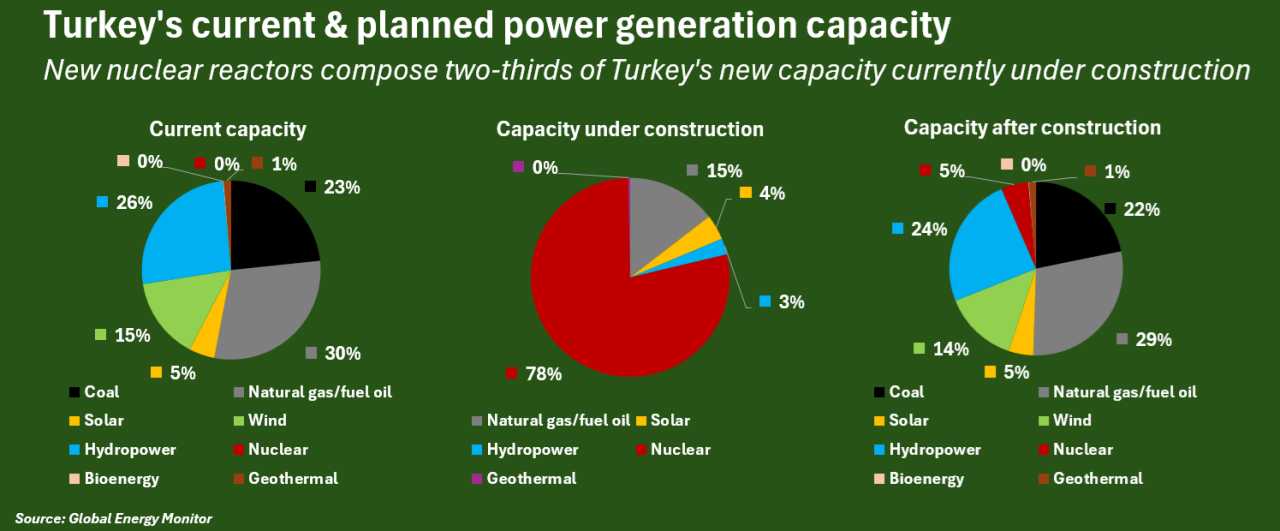

Turkey has 4,800 megawatts (MW) of nuclear generation capacity in development, according to Global Energy Monitor (GEM), which is the third largest nuclear pipeline globally. The country currently has no operating nuclear power plants.

The first unit of the new Akkuyu plant is due to start production this year, and once fully operational is expected to generate around 10% of Turkey's electricity.

However, the Russia-built facility on the south coast, which commenced site construction in 2013, has been beset by numerous delays and cost overruns that raise questions about the likelihood of a timely start-up of its planned four stages.

And given that Turkey is already one of the world's largest coal consumers, any delays in nuclear operations will trigger a potential acceleration in coal-fired power output in the country, which is undergoing a steep climb in power demand.

Nuclear phases, sanctions

The first unit of the Akkuyu facility, built by Russia's State Atomic Energy Corporation Rosatom, is due online this year, with a nameplate capacity of around 1,200 MW.

Equipment start-up and testing of the pressurized water reactor's pumping station and cooling systems began earlier this month, and the site passed an independent safety inspection in January, according to Akkuyu's website.

The three remaining 1,200 MW units are due to be added one per year in 2026, 2027 and 2028, at a total estimated cost of around $20 billion.

Given the advanced state of general construction at the site, the completion of the remaining reactors on the scheduled pace is feasible.

However, due to the strict sanctions on several Russian entities following Russia's invasion of Ukraine in 2022, Rosatom has reported difficulties in acquiring certain parts from suppliers.

Further delays and sourcing difficulties could emerge going forward following the imposition of new sanctions targeting Russia by the new administration of U.S. President Donald Trump.

Coal crutch

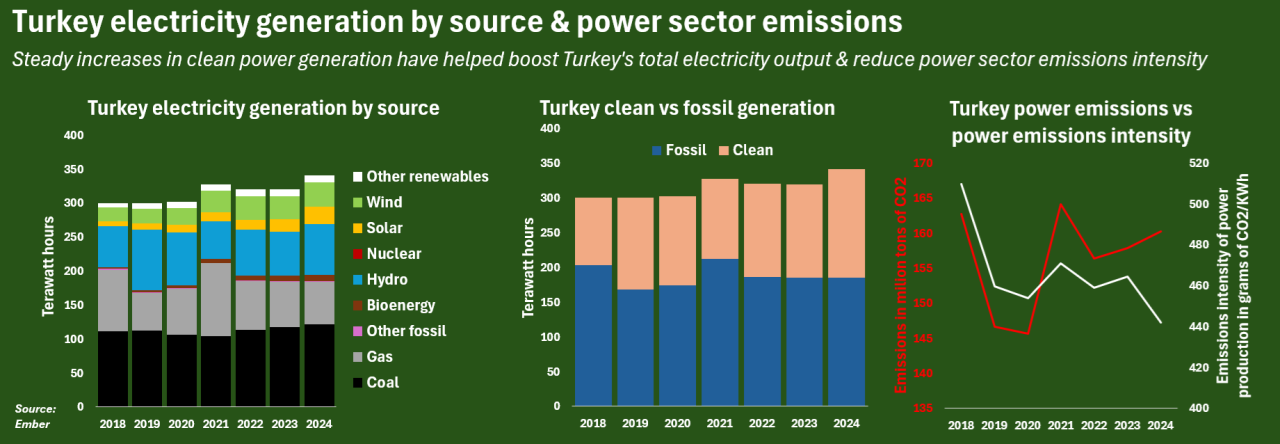

While the finishing touches to Turkey's first nuclear plant are made, the country's power firms continue to crank output from the country's fleet of coal-fired plants, which supplied around 35% of Turkey's electricity last year.

Its coal plants generated a record 121 terawatt hours (TWh) of electricity in 2024, according to energy think tank Ember, and discharged a record 114 million tons of carbon dioxide, which was the most in Europe from coal-fired generation.

To feed the country's roughly 55 coal plants, around 26.5 million metric tons of thermal coal was imported by Turkey in 2024, according to ship-tracking firm Kpler, which was the eighth largest national import total globally.

Hydropower plants generated the second largest amount of electricity in Turkey last year, around 75 TWh, while gas plants generated around 63 TWh.

However, volatility in precipitation levels and gas prices has served to stifle the growth in hydro and gas-fired generation in recent years, and has forced Turkey's power firms to remain reliant on coal for the lion's share of power output.

Capacity cluster

Judging by Turkey's power capacity pipeline, the country's firms have no 'Plan B' in place in case of major delays to the Akkuyu plant start-up.

There is no additional coal-fired capacity currently under construction, and only 890 MW of new gas-fired capacity is in the works, according to energy data organisation GEM.

In terms of non-nuclear clean capacity, some 250 MW of solar, 160 MW of hydro power and around 20 MW of geothermal capacity is also under construction.

Upon completion, the new capacity additions will boost clean energy's share of Turkey's capacity mix to 49.5%, from 47% currently, and reduce the fossil fuel share to 50.5% from 53%.

However, the sum total of all non-nuclear capacity currently being built in Turkey is less than 30% of the planned capacity growth in nuclear.

That paucity of alternative capacity development speaks to the country's confidence in getting the nuclear plants up and running quite soon.

But the limited scope for boosting power production without the new nuclear fleet also means that Turkey's power firms will remain beholden to the current swath of fossil fuel plants until the country finally does begin its nuclear age.

Turkey nuclear plant faces delays as Russia seeks parts in ChinaDiplomacy

Turkey nuclear plant faces delays as Russia seeks parts in ChinaDiplomacy Turkey, US discuss nuclear plant projects, says Turkish officialsDiplomacy

Turkey, US discuss nuclear plant projects, says Turkish officialsDiplomacy Climate Investment Funds approves $1B plan to upgrade Turkey's power gridEconomy

Climate Investment Funds approves $1B plan to upgrade Turkey's power gridEconomy