Turkish central bank cuts rates by 250 points for second time in a row

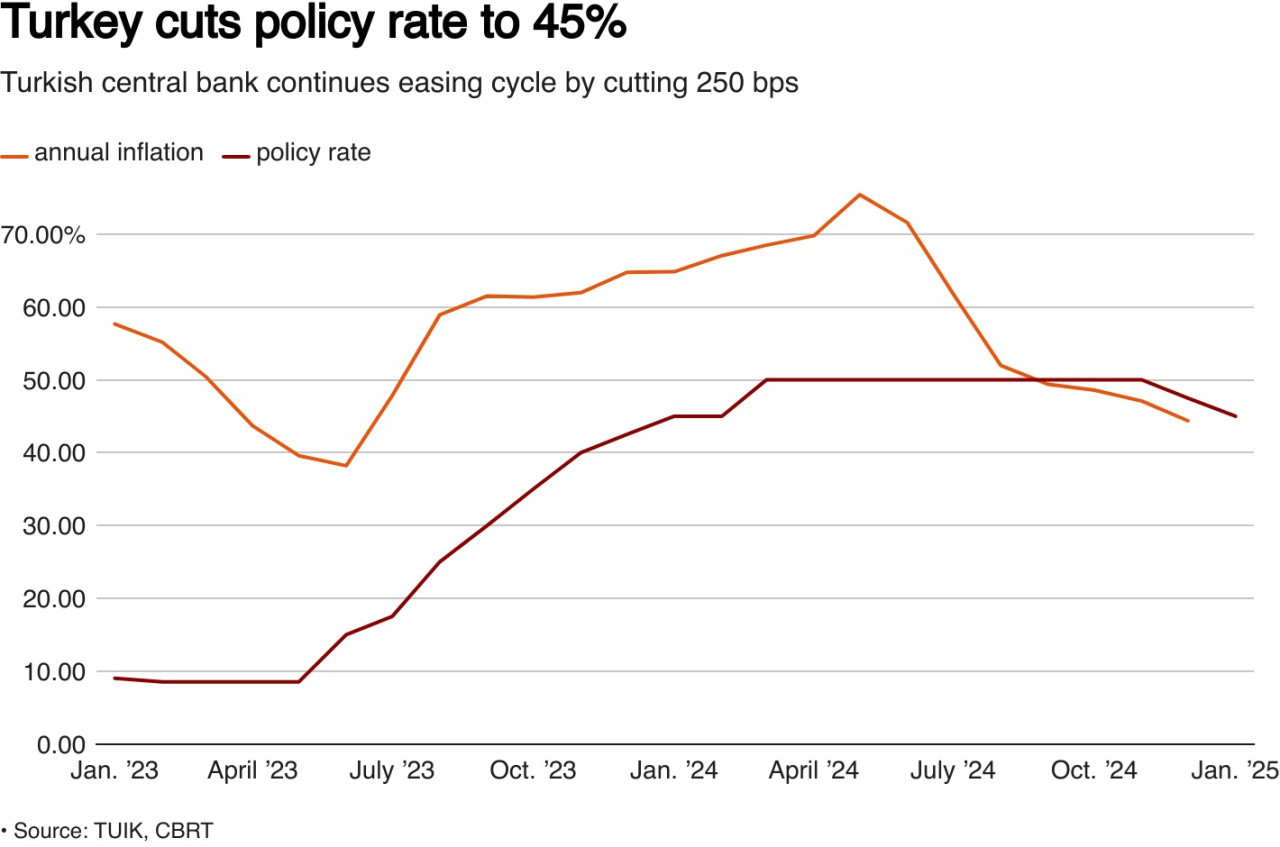

Turkey's central bank once again cut its key interest rate by 250 basis points to 45 percent, continuing the easing cycle came after an 18-month tightening effort amid high inflation rates and economic turmoil.

Reuters

Turkey's central bank cut its key interest rate by 250 basis points to 45% as expected on Jan. 23, carrying on an easing cycle, opens new tab it launched last month alongside a decline in annual inflation that is seen continuing through the year end.

The bank indicated it would continue easing in the months ahead, flagging a temporary rise in January inflation driven mainly by services, even as core inflation remains relatively low with domestic demand at "disinflationary levels".

In a Reuters poll, all 13 respondents forecast a cut to 45% from 47.5% in the one-week repo rate. They expect it to hit 30% by year end, according to the poll median.

Annual inflation dipped to 44.38% last month in what the central bank believes is a sustained fall toward a 5% target over a few more years. It topped 75% in May last year.

Given the decline in inflation, "pretty much now everyone wants to own (local Turkish debt)," said Yerlan Syzdykov, global head of emerging markets and co-head of emerging markets fixed income at Amundi, Europe's largest asset manager.

"We share that perception that disinflationary forces will create an opportunity for us to see both lower inflation and lower rates in Turkey on the local side," he told Reuters.

In December, the central bank cut rates for the first time, opens new tab for the first time after an 18-month tightening effort that reversed years of unorthodox economic policies and easy money championed by President Recep Tayyip Erdoğan, who has since supported the steps.

It had raised the rate by 4,150 basis points in total since mid-2023 and kept it at 50% for eight months before beginning easing.

"While inflation expectations and pricing behaviour tend to improve, they continue to pose risks to the disinflation process," the bank's policy committee said after its decision.

In a slight change to its guidance, the bank said it will maintain a tight stance "until price stability is achieved via a sustained decline in inflation."

Last month, it said it would be maintained until "a significant and sustained decline in the underlying trend of monthly inflation is observed and inflation expectations converge to the projected forecast range."

A 30% administered rise in the minimum wage for 2025 was lower than workers had requested, though it is expected to boost monthly inflation readings this month and next, economists say.

The central bank has eight monetary policy meetings set for this year, down from 12 last year.

New minimum wage falls short of rent in over half of Istanbul's districtsEconomy

New minimum wage falls short of rent in over half of Istanbul's districtsEconomy Turkey increases minimum wage by 30 percent, 17 percentage points below inflation rateEconomy

Turkey increases minimum wage by 30 percent, 17 percentage points below inflation rateEconomy Turkey’s official inflation falls to 44 percent in DecemberEconomy

Turkey’s official inflation falls to 44 percent in DecemberEconomy