Turkish Finance Minister praises record inflation at 75 pct, expects 'disinflation' to start

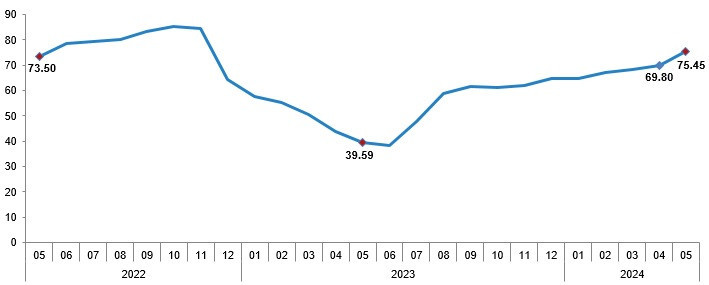

Turkish annual consumer price inflation peaked at 75.45 percent in May, according to official data from state-run TÜİK. Finance Minister Mehmet Şimşek said, "The transition period in the fight against inflation has thus been completed, we are entering the disinflation process."

Duvar English

Turkish annual consumer price inflation reached 75.45% in May, a bit above expectations, according to official data on June 3, in what is expected to be the high water mark before a series of rate hikes and relative lira stability bring relief.

The consumer price index rise was driven by strong advances in education, housing and restaurant prices last month.

Monthly inflation is also expected to ease after May, during which it was 3.37%, according to the Turkish Statistical Institute, compared with 3.18% in April. Annual inflation in April was 69.80%.

In a Reuters poll, annual inflation was forecast to peak at 74.8% in May, its highest level since November 2022, before dropping to 42.6% by the end of 2024. Forecasts for month-on-month price rises ranged between 2.7% and 3.3%.

The central bank has raised its policy rate (TRINT=ECI), opens new tab by 4,150 basis points since June last year. It reversed years of monetary stimulus that was championed by President Recep Tayyip Erdoğan to boost growth, but which sent inflation soaring.

The bank last raised rates in March, by 500 basis points to 50%, citing a worsening inflation outlook. It has since held steady and vowed to tighten more if there is "a significant and persistent deterioration" in the outlook.

The reversal has drawn foreign investor interest and helped boost the central bank's foreign reserves, which are at the highest level since December on a net basis.

International investors are ramping up exposure to Turkey, focusing on local bonds and credit default swaps as monetary policy normalization becomes more deep-rooted, investors and analysts say.

Last month, the central bank nudged up its year-end inflation forecast to 38% and said it would "do whatever it takes" to avoid any longer-term deterioration in the outlook.

In January and February, monthly inflation climbed 6.7% and 4.53% respectively, largely due to a big minimum wage hike and an array of new-year price updates. In March and April, the rise in inflation slowed to around 3.2%.

The domestic producer price index was up 1.96% month-on-month in May for an annual rise of 57.68%, the data showed.

Following the announcement of the inflation data, Treasury and Finance Minister Mehmet Şimşek said, "The transition period in the fight against inflation has thus been completed, we are entering the disinflation process."

"The worst is behind us! Annual inflation, which includes the cumulative effects of the past 12 months, reached its highest level this month. (...) The permanent decline in inflation will start in June. Annual inflation will most likely fall below 50 percent by the end of the third quarter," Şimşek noted.

The minister expected annual inflation to be 33.2 percent after 12 months and 21.3 percent after 24 months.

En kötüsü geride kaldı!

— Mehmet Simsek (@memetsimsek) June 3, 2024

Geçmiş 12 ayın birikimli etkilerini içeren yıllık enflasyonda en yüksek seviyeyi bu ay gördük. Enflasyonla mücadelede geçiş dönemi böylece tamamlandı, dezenflasyon sürecine giriyoruz.

Enflasyonda kalıcı düşüş haziranda başlayacak. Yıllık enflasyon… pic.twitter.com/oA2OPrMr87

Daily price of balanced, healthy diet reaches 600 liras in TurkeyEconomy

Daily price of balanced, healthy diet reaches 600 liras in TurkeyEconomy Istanbul's annual inflation hits 82.2 pct, chamber of commerce reportsEconomy

Istanbul's annual inflation hits 82.2 pct, chamber of commerce reportsEconomy Turkey’s central bank holds interest rates steady again at 50 pctEconomy

Turkey’s central bank holds interest rates steady again at 50 pctEconomy