Turkish state banks slash rates on commercial and housing loans after Central Bank move

Following the Central Bank's shock interest-rate cut of 100 basis points, Turkish state banks lowered borrowing costs on commercial and housing loans by up to 100 basis points.

Duvar English

Turkey's state banks cut interest rates on Nov. 19 on an array of loans by up to 100 basis points, following a sharp policy easing by the Central Bank a day before.

The interest rate cuts will be also valid for housing loans, state-run Anadolu Agency reported.

For housing loans below 1 million liras, the interest rate has been lowered to 1.20 percent, while for housing loans above 1 million liras, it has been lowered to 1.29 percent.

The Turkish lira suffered one of its worst days in three years on Nov. 18 after the Central Bank defied warnings of a full-blown currency meltdown and rocketing inflation, and slashed interest rates by 100 basis points.

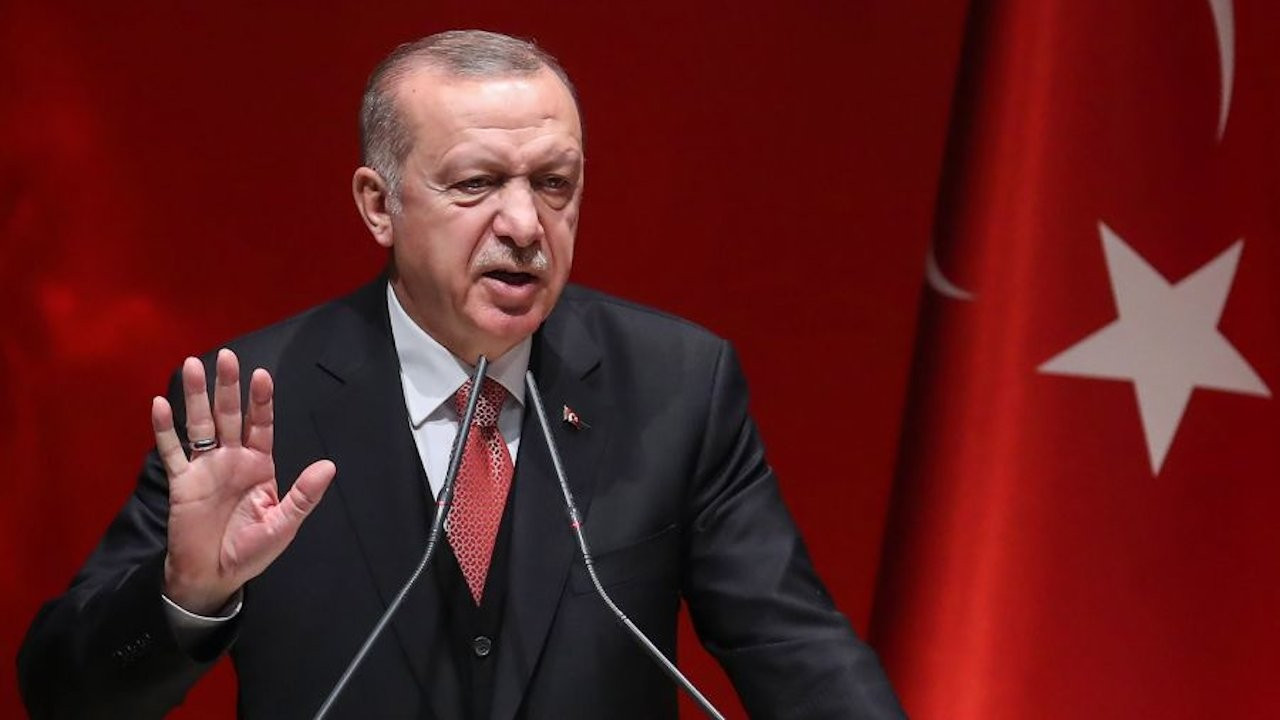

President Recep Tayyip Erdoğan takes the unorthodox view that lower rates are the only way to curb inflation. Not only has he seemingly got his way this time, but his Central Bank chief hinted at another cut next month.

Economists warn Turkey now risks even higher inflation - 30 percent potentially - and full currency meltdown unless the course changes and rates are raised.

AKP officials say Finance Minister may leave post soonPolitics

AKP officials say Finance Minister may leave post soonPolitics Stop!: Turkish main opposition leader to Erdoğan after central bank rate cutEconomy

Stop!: Turkish main opposition leader to Erdoğan after central bank rate cutEconomy Turkey forges on with 100-point rate cut despite lira meltdownEconomy

Turkey forges on with 100-point rate cut despite lira meltdownEconomy Turkish opposition leaders call for early elections amid lira's downfallPolitics

Turkish opposition leaders call for early elections amid lira's downfallPolitics